HAVE A QUESTION? CALL US AT (872) 266-3015

The Estate Planning Mistake That’s Costing Retirees More Than They Realize

We’ve all seen the headlines: “Estate tax exemption raised to $15 million!” And at first glance, it sounds like a green light to stop worrying, especially if your estate is comfortably below that threshold. But those headlines don’t tell the whole story. In fact, for many retirees, they’ve created a false sense of security.

By Nate Crannell

August 26th, 2025 | 6 Min. Read

Because here’s what isn’t said nearly enough: It’s not just the federal government that wants a slice of your estate.

The Federal Headline That’s Lulling People to Sleep

With the passing of The One, Big, Beautiful Bill (OBBB), the federal estate and gift tax exemption is rising to $15 million per person ($30 million per couple) in 2026, indexed for inflation. And the 40% top tax rate? That stays where it is.

So yes, it’s a meaningful change. And yes, for most people, it sounds like the problem is solved.

But what the headlines forget to mention is that estate tax isn’t just a federal issue. And in some states, it’s quietly draining millions from estates that assumed they were “in the clear.”

The Trap Door That Most People Miss

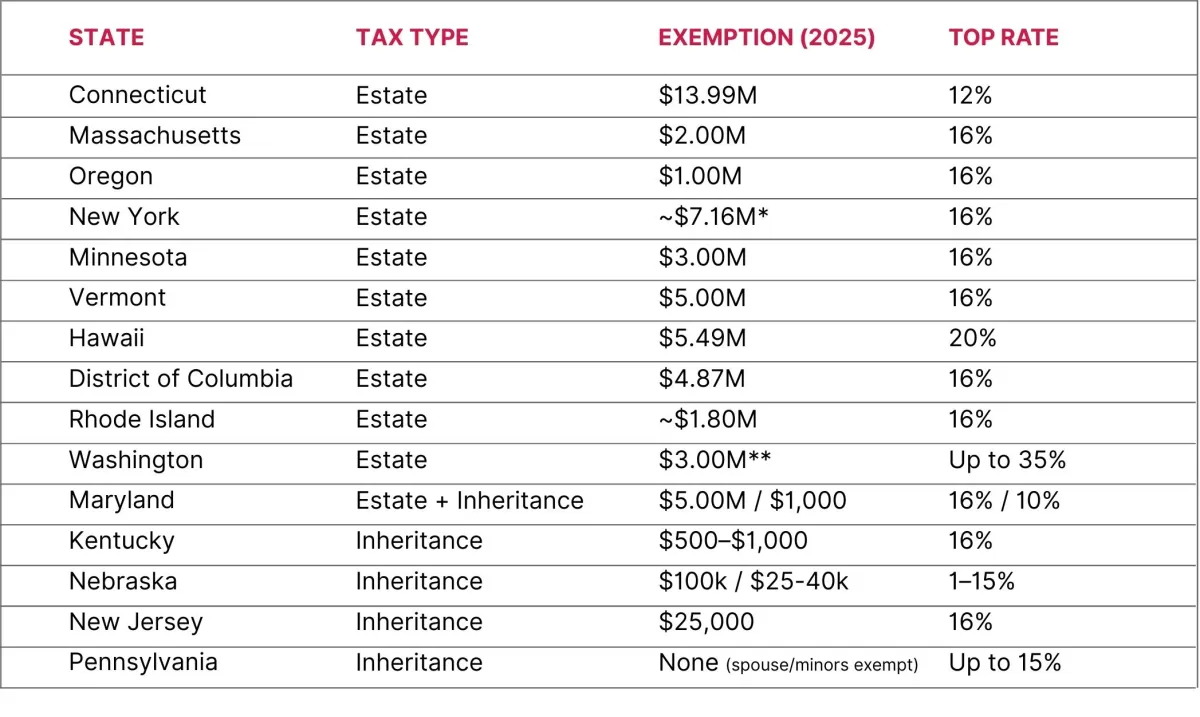

Twelve states and Washington, D.C. impose their own estate taxes. Six states levy inheritance taxes. Some do both.

Which means you could be under the federal exemption and still owe six or even seven figures in state estate tax just because of where you live, or where you own property.

The contrast from state to state is staggering. While Connecticut aligns closely with the federal exemption at nearly $14 million, states like Massachusetts and Oregon start taxing estates at just $2 million and $1 million, respectively. On the high end, Washington doesn’t just have a relatively low exemption at $3 million, it tops out with a 35% estate tax rate, the highest in the country. Meanwhile, New York adds another twist: if your estate exceeds the exemption by just 5%, you lose the exemption entirely. These kinds of discrepancies are why a plan that works in one state can completely fall apart in another.

(See the chart at the end of this article for a full breakdown of state exemptions and top estate tax rates.)

The Real Cost Isn’t Just the Tax

It’s not just about what you owe. It’s about what has to happen to pay the bill.

Let’s say you’re “only” facing $100,000 in state estate tax. That may not sound catastrophic until you realize your heirs may have to sell property or liquidate investments just to cover that bill.

And if you think this only happens in legal textbooks, just look at the hit TV series Yellowstone. The entire show hinges on what happens when estate planning is put off too long.

After John Dutton’s death, the family is left with a massive estate tax bill and very little time to solve it. With most of their wealth tied up in land and livestock, they’re forced to start selling assets, quickly, just to cover the tax.

It’s a fictional ranch, but the timeline and financial pressure are all too real. When there’s no plan for estate taxes, even a well-run family business or legacy property can become a liability overnight.

And remember, estate tax liability isn’t always based on where you live, but where your assets live.

But Wait... I Live in a No-Tax State?

That doesn’t mean you’re safe.

If you own a vacation home or rental property in a state that does levy estate tax, part of your estate can still be taxed there even if you live elsewhere.

Some states, like Oregon and Washington, use a formula to calculate tax as if your entire estate lived there, then apply a percentage based on how much of your estate is in the state.

Even a modest $1 million property can drag a much larger estate into state-level taxation.

So, What Can Be Done?

This is where most people freeze. They know there’s a problem, but they’re not sure what to do with it.

The good news is: this isn’t a mystery if you know where to look. Most estate tax exposure can be reduced, or even avoided, if it’s addressed ahead of time. Here are five strategies that retirees are using right now:

1. Map Your State Exposure

Start with geography. What states do you live in, own property in, or have business interests in? Even if the asset is small, it can create a big tax footprint.

2. Use State‑Specific Trusts

Trusts can remove assets from your taxable estate but where and how they’re structured matters. Some states are more favorable for trust planning. A properly placed trust can block exposure before it starts.

3. Rethink Vacation Homes or Rentals

Owning a home out-of-state? Consider structuring it inside an LLC owned by a trust, or explore tools like QPRTs. These aren’t one-size-fits-all but they can be powerful when used intentionally.

4. Leverage Strategic Gifting

Gifting during your lifetime, especially of appreciating assets, can reduce your estate’s size before it crosses a state threshold. Just know: states don’t always follow the IRS gift rules.

5. Prepare for Liquidity

Even if you accept some tax exposure, plan for it. Life insurance, liquid investment accounts, or even designated funds can ensure that your heirs aren’t forced into a fire sale.

Where Do You Go From Here?

Here’s the thing: estate taxes aren’t just a rich person’s problem anymore. Not when states like Massachusetts tax estates above $2 million... and homes in those areas are worth that all by themselves.

And it’s not just the ultra-wealthy who get caught.

It’s people with a well-earned nest egg, a house they’ve paid off, and a few smart investments that grew over time.

The federal exemption is big. But the red flags?

They live in the fine print, and the state laws no one ever taught you about.

If you're reading this and wondering how it applies to your specific situation, you’re not alone. We hear from retirees every week who thought they were in the clear until a second look revealed an overlooked threshold, a wrong location, or a hidden trap door.

Most of the time, the fix is simple - but only if you spot it early.

We offer a complimentary Red Flag Review Call, just to help people see their own landscape more clearly. It’s not a sales pitch. It’s a planning conversation. You bring your questions, we’ll help you sort through the state-by-state details and figure out if your estate might be waving a quiet red flag. (This call is for educational purposes only and is not a financial advising call.)

Because tax law doesn’t care if you knew the rules.

A Tale of Two Thresholds

Here’s a look at the state-level differences in estate and inheritance taxes for 2025:

*Note on New York: The state offers a generous estate tax exemption but with a dangerous twist. If your estate exceeds that amount by just 5% or more, you don’t just get taxed on the overage, you lose the entire exemption. That means your whole estate becomes taxable, triggering hundreds of thousands (or more) in unexpected estate tax. It's not a soft penalty. It’s a hard cliff. And too many families don’t realize they’re standing on the edge until it’s too late.

**Note on Washington: Effective July 1, 2025, Washington raises its filing threshold to $3 million, but applies a steep graduated tax up to 35% - the highest state estate tax rate in the country. That rate kicks in at just $9 million, far below the new federal exemption. Families with Washington ties must be especially vigilant.

Because common sense isn't always 'common', here is the legal disclosure: This article is for informational purposes only and does not constitute financial, investment, tax, or legal advice. Retirement Red Flags does not guarantee the accuracy or completeness of the information provided. All investments involve risk, including potential loss of principal. Readers should conduct their own research and consult with a professional advisor before making any financial decisions. I am not an attorney, CPA, or financial advisor.